Car Insurance Quote Comparison Websites Save You Time, But Watch for Privacy Pitfalls

Some sites sell your personal data to agents and marketers who can target you with calls, emails, and texts

For decades, Consumer Reports has offered drivers an unwavering recommendation for saving money: Shop around regularly for car insurance, ideally once a year.

It’s good advice, but easier said than done. Geico’s ads say 15 minutes could save you 15 percent or more on car insurance, but multiply that by a dozen companies and you’ve eaten up an afternoon entering your address, car model, coverage preferences, and other details over and over again.

To make shopping easier, a slew of quote-comparison websites promise to bring you insurance quotes from several carriers in exchange for some basic information about you and your car.

Comparison Sites Are a Good Place to Start

No quote-comparison site is perfect, but some of them can help you get a lay of the land as you begin shopping around.

Sites that let you compare several quotes directly include Experian, Jerry, Policygenius, Way.com, and The Zebra. They function like a traditional independent insurance agent you’d call up on the phone, except they let you shop at your own pace online.

When they work well, they’re useful tools. But depending on your situation, they can be hit-or-miss.

Since each company has relationships with different insurance carriers, you likely won’t get the same set of quotes from any of them. And none that we came across displayed a quote from every major carrier. In fact, Farmers and State Farm are among several insurers that don’t allow independent insurance agents to sell their policies at all, experts tell CR—whether online, in person or over the phone. (Neither insurer responded to CR’s questions about how they work with independent agents.)

The quotes that do appear on comparison sites are usually preliminary estimates, which isn’t always obvious as you go through the process. If you have at-fault collisions or less-than-stellar credit that you didn’t disclose in the initial questionnaire, for example, you might end up with a higher final quote once you finish the process.

Where you live matters a lot: I live in California, where industry experts say auto insurers are currently hesitant to write new policies, so I got very few quotes from the comparison sites I tried. But I got a ton of quotes when I tested the sites using personal information from a colleague in Texas (with her permission!).

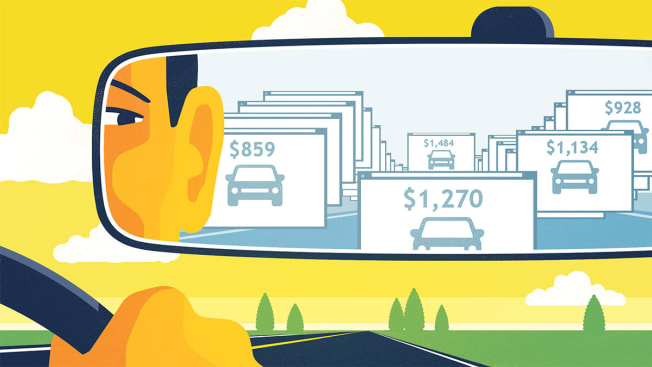

Using my colleague’s details, I compared initial quotes from five comparison sites with quotes I got directly from insurance companies—and I found some pretty big differences. Most quotes from comparison sites were $10 to $40 off per month from the quotes I got directly from the same insurers, with the same details and coverage levels. Annually, that adds up to a $120 to $480 difference.

Usually, comparison sites quoted higher rates than the insurers did. That could be because of my colleague’s great credit and clean driving record, so the same pattern may not hold for everyone.

But it’s not always apples to apples: In some cases, comparison sites get quotes from a different subsidiary of an insurance company than the one you can access as a consumer, says Ezra Peterson, senior director of insurance at Way.com.

Getting initial quotes right is a “really hard part of the business,” says Mike Grabowski, senior vice president for product at The Zebra. “We focus on making sure the quotes we’re showing you are as accurate as possible,” Grabowski says. “And we’re still working on that.”

Some Sites Sell Your Data

Certain quote-comparison sites ask you a series of questions about yourself, your driving record, and your car—then they sell those details to insurance companies and brokers, who can follow up with calls, emails, and texts.

Many of these sites are lead generators: companies that capture shoppers’ personal information in order to sell or share it. Major lead generators dealing in car insurance include QuoteWizard, EverQuote, and Insurance.com, which is part of a group of sites owned by a company called QuinStreet that also includes Insure.com and CarInsurance.com.

Companies like these say their practice helps consumers cast a wider net. There are more than a thousand car insurance companies in the U.S., some of which insure specific driver profiles in a limited area. Certain smaller carriers don’t work directly with consumers—they rely on agents to connect them to potential customers. Without a shopping service, lead generators argue, you’ll never be able to find the best deal quickly.

“To actually shop around competitively you’re gonna have to talk to a few people,” says Ian Smith, head of insurance at QuoteWizard. “Marketplaces like ours allow you to connect with people who can help you.”

But using lead generators means giving up some control of your personal data. And any time you might have saved by comparing quotes online might evaporate as you field calls and texts from insurers and agents.

At the end of the information-gathering process, lead generation sites ask for permission to share your personal data with other companies. For example, fine print on EverQuote’s website says “By clicking Show My Quotes and submitting this form, I am providing express written consent to being contacted by you, EverQuote Marketing Partners, or by one or more agents or brokers of your partners.”

It also says that by clicking the big blue button, you agree to receive telemarketing calls and texts—even if your phone number is on the Do Not Call registry. EverQuote’s list of marketing partners has 683 companies on it, some of which have nothing to do with insurance at all: The list includes a mortgage lead-generation company, several solar panel companies, and some vehicle warranty providers. (In an example of how circular this industry is, QuoteWizard and The Zebra are among EverQuote’s marketing partners, too.) EverQuote representatives didn’t respond to CR’s interview requests.

Disclaimers like these appear to be typical of lead-generation sites. These companies can sell a person’s data for anywhere from less than a buck to hundreds of dollars a pop, according to Eric Troutman, a lawyer who heads up a trade association of lead-generation companies.

And there are no limits on how many times a company can resell your info, which means a visit to an unscrupulous site can send your details bouncing from company to company indefinitely.

“One consumer may literally receive thousands of phone calls for months, if not years, based on one webform submission,” Troutman says. “And there’s no way to stop it.” He says “bad actors” in the industry (whom Troutman says he doesn’t represent) are dragging down the reputation of lead generators that act responsibly.

Big Changes Coming?

The lead-generation industry was set on fire by a recent government proposal that could change everything about how they’re allowed to interact with consumers.

The Federal Communications Commission is considering new rules that would require lead generators to get your express permission for each company they want to sell to, rather than asking you once for permission to share it with a big list of companies hidden behind a hyperlink.

This proposal, which came out of a request from Public Knowledge, a nonprofit digital advocacy group, would represent an earthquake for lead generators. Troutman’s trade association wrote in a comment to the FCC that it “guts an industry [and] harms consumers.”

For their part, consumer advocates aren’t too worried about that possibility. “We think consumers would be really really happy if they didn’t have to sign up for robocalls in order to get the info they think they’re getting,” says Margot Saunders, a senior attorney at the National Consumer Law Center who co-authored comments supporting the Public Knowledge proposal.

In June, 28 state attorneys general wrote a letter supporting the consumer groups’ position, giving it a significant boost. The FCC says it doesn’t have a public timeline for making a decision.

What You Should Do

It’s smart to shop around for insurance quotes—Consumer Reports experts recommend you do so annually, more or less—but it’s hard to rely on any one website to bring you all the options. Just like an insurance agent you’d call up on the phone, every comparison site has a limited view into insurers. And that’s if they provide you with quotes at all.

Check to see if the company is licensed to sell insurance. Your best hint at whether a quote-comparison site will serve you up real quotes may be whether or not the company is registered as an insurance agent in your state. Without a license to sell insurance, a company generally can’t give you quotes at all—at best, it can hand you off to licensed agents elsewhere. You can find out if a company is licensed by calling its customer service line and asking directly, or by contacting your state’s insurance commissioner office.

Check the company’s terms and policies. One major challenge is that you can’t always tell which companies are going to sell your personal information. So if you’re considering starting your search with a quote-comparison website, have a quick look at the company’s terms of service and privacy policy, which is usually accessible at the very bottom of each page on a site.

These pages are chock-full of legalese, but you can use some strategic word searching to find the important bits, where the companies tell you what they intend to do with the data you give them. Look for the words “sell” and “share,” for starters. For example, Jerry’s privacy policy says, “We will not share your personal information with third parties without your consent,” and it’s very specific about when and why it does so. EverQuote’s policy says, “We will share information with our business partners and other third parties. These partners may send you information about products and services by telephone, text, fax, mail or email.”

Opt out of further communication once you’re done. After you use a quote-comparison site, you’ll probably get a whole bunch of follow-up emails, calls, or texts, whether they’re from companies you want to hear from or from other marketers. So after you’re done shopping for insurance—or if you just don’t want to be bothered anymore—you should be able to opt out of receiving further communication. Just Google the company you’re hearing from and the words “opt out” and you should land on a page that tells you how to do it.

But beware: If you shared your information with a lead generator that turned around and resold it widely, asking it to stop selling your data won’t necessarily claw it back from the companies it was already sold to. You may find yourself telling a lot of companies you’ve never heard of to stop contacting you.

Get direct quotes from some insurers, too. Because quote-comparison sites don’t have access to quotes from some major carriers, it’s worth getting quotes directly from some insurers, too. CR’s car insurance ratings can help you look for insurers that have the best customer service, good coverage options, and the lowest premiums—including some carriers you might not have thought of.